Would you believe me if I told you that accounting for artists is actually pretty easy?? It's true!

If you start out the beginning of every year and month with a few organizational habits in place, you will spend so little time and effort having to keep track of all of your expenses (art + office supplies) and income (art sales!). Then once it's time to do your sales taxes or small business taxes it will be a literal breeze.

There are scores of blank ledger PDF’s you can print out online, or just use an Excel spreadsheet, or even simply drawing some vertical lines in a $1 notebook if you like the pen-to-paper method. It takes almost nothing to get started on the right track and you will never regret being more organized :)

Things to Remember:

Separate your personal from your business bank accounts and credit cards.

Decide how you would like to keep track of expenses and income (whether digital or a paper ledger) and stick to it! Wave is my fave free software.

If you decide to go digital, integrate your bank and credit accounts within the software and make sure they stay accurate.

Figure out your list of categories for the different ways/reasons you may get paid. You can always add more later.

Figure out your list of categories for all the different expenses you will have. Sometimes it help to just brainstorm up a huge list of everything it takes for you to run your art business and then see how to make those things either go together or separate. You can always add more later, and feel free to use as many of mine in the video as work for your small biz too!

Make sure to save and log receipts for paper ledgers and keep up with automatic transaction imports via the digital ledger no less than every 2-4 weeks. Trust me, it gets hard to remember what is what if you wait any longer than that.

You can use your super organized finances at the end of every month to pay your biz sales taxes as well as at the end of the year to do your personal state and federal income taxes so much easier now - ta daa!

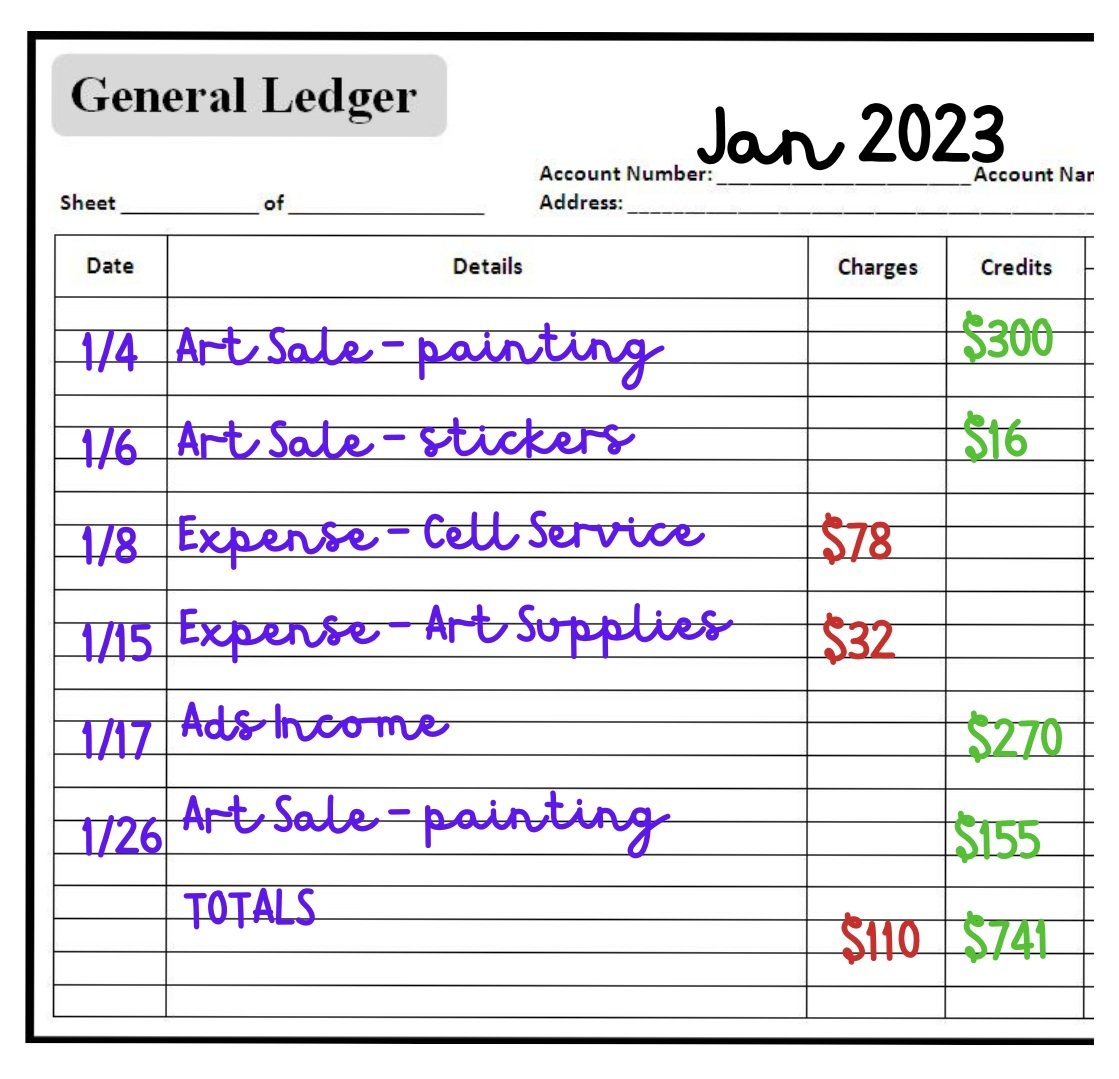

My Examples in the Video:

Putting everything together on one page:

Having one page for all expenses and another for all income; can be done by the month or by the year:

Separating each category of expense or income onto its own sheet; most likely done by the year.:

1.22.2023